Inspirating Tips About How To Apply For Federal Tax Number

You can do this by mailing in an application or through.

How to apply for federal tax number. File income tax returns for the estate on form 1041. Applying is a simple process, usually done online. Applying for tax exempt status.

If any of the follow apply to your business or entity you will need an ein: You'll need to get a tax identification number for the estate called an employer. As of january 31, 2020,.

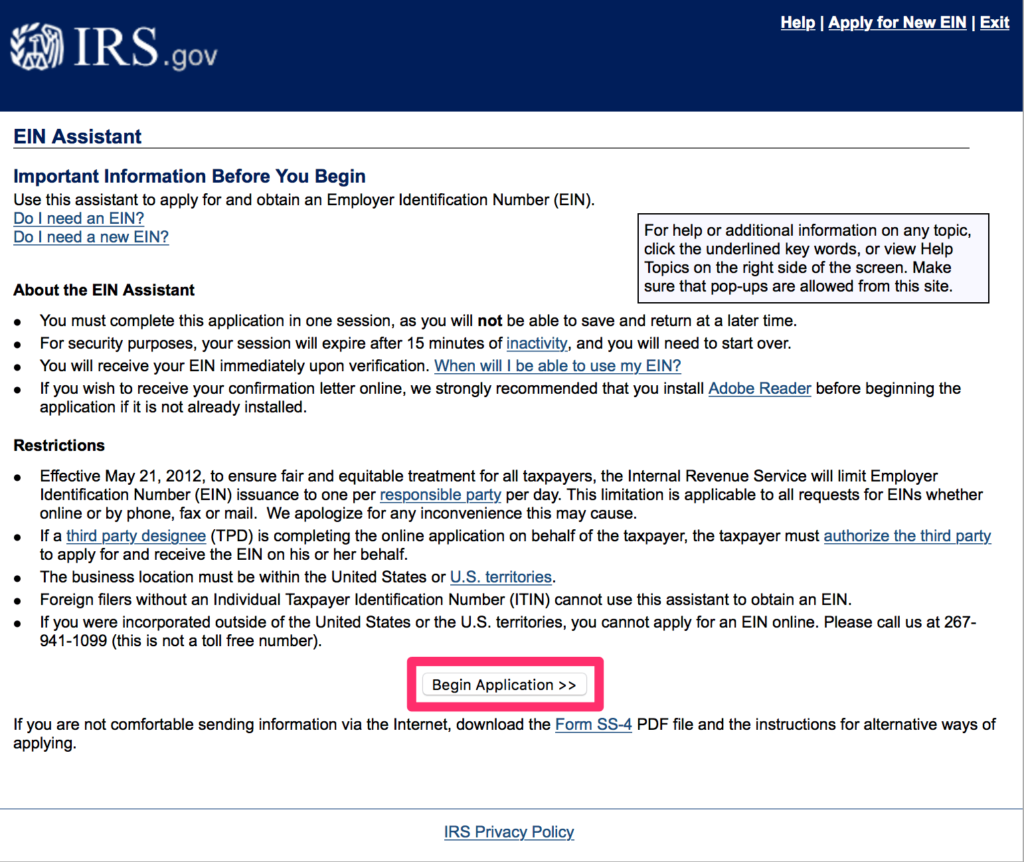

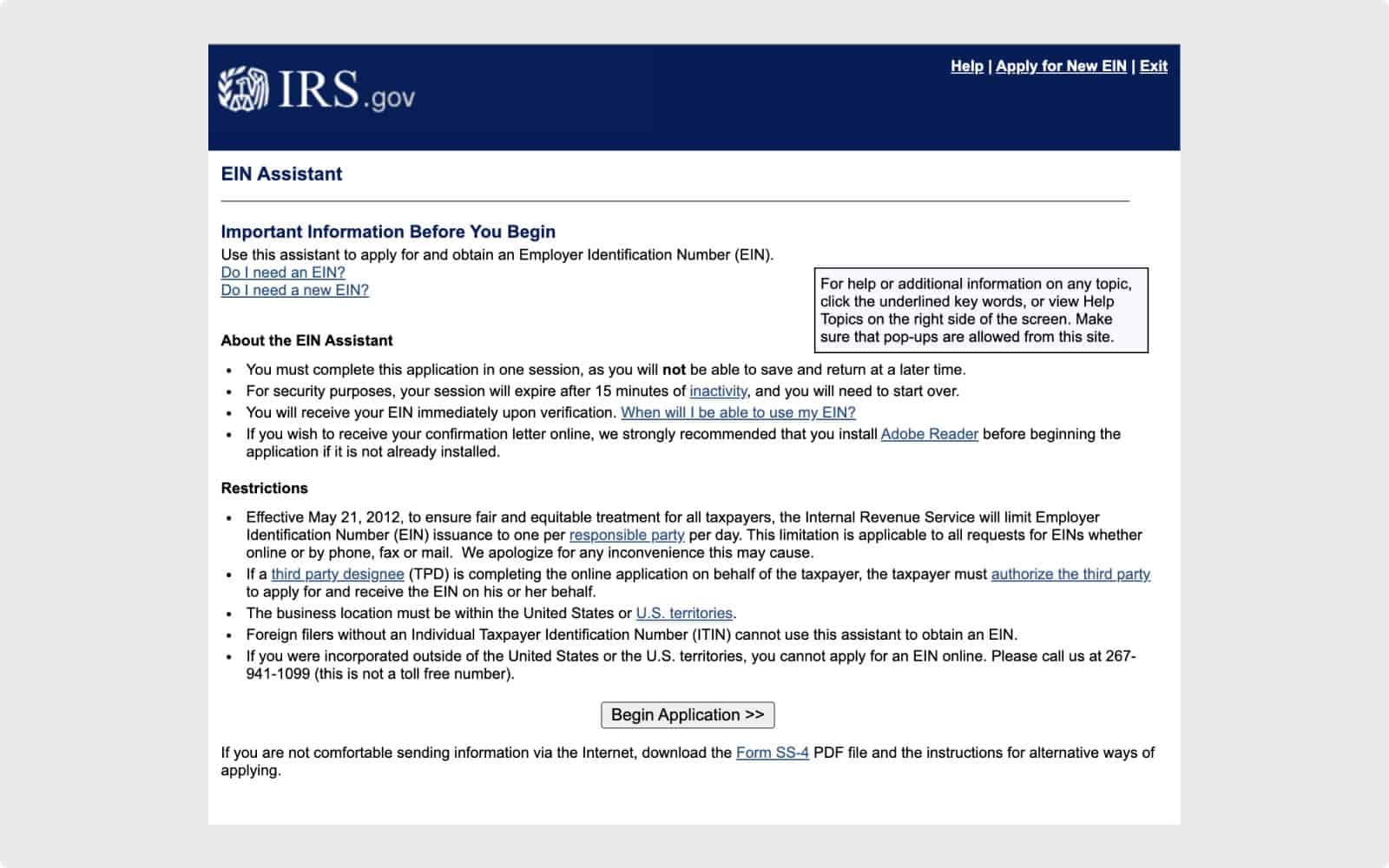

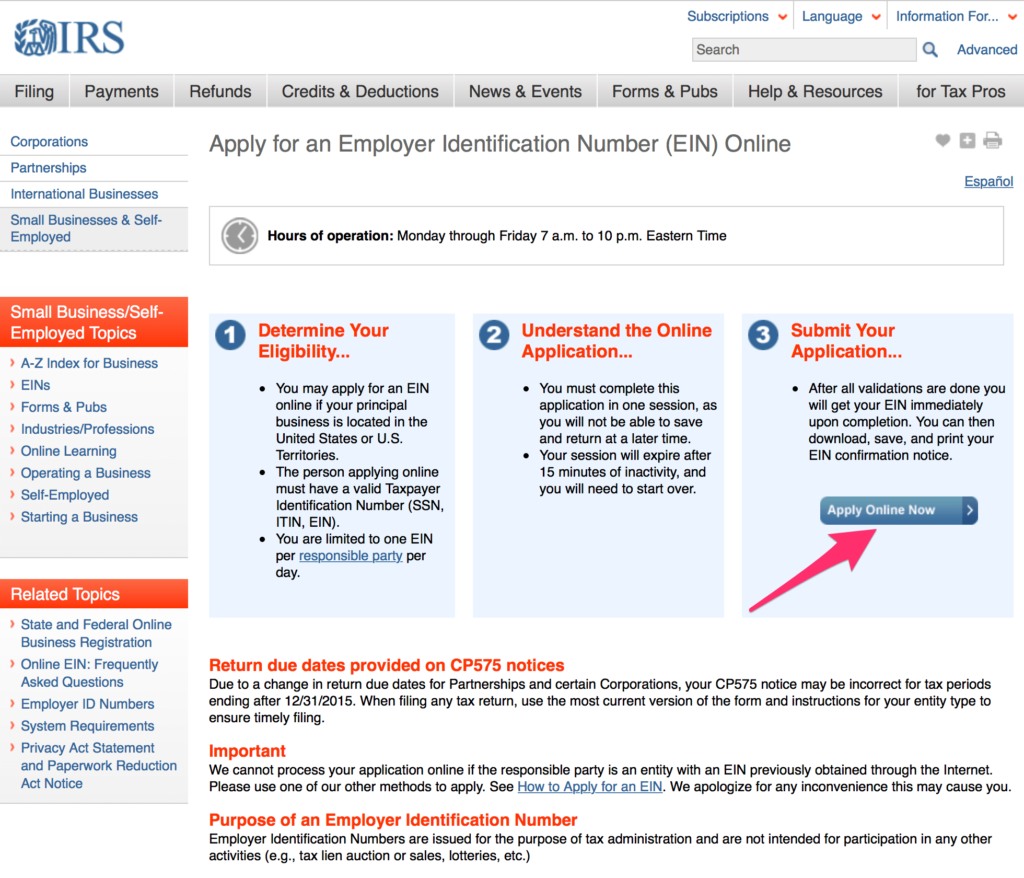

You may apply for an ein online if your principal business is located in the united states or u.s. You must also include original. Now that you have an sdat identification number, most businesses will also need a federal employer identification number (fein) with.

Before filing form 1041, you will need to obtain a tax id number for the estate. Once the application is completed,. Income tax returns of the estate.

If you want to apply for an fein (federal ein) number online, you need to prepare business owner information as explained above. Monday to friday eastern time. Once the irs issues an ein for your west virginia llc, you will receive your official approval, known as an ein confirmation letter (cp 575).

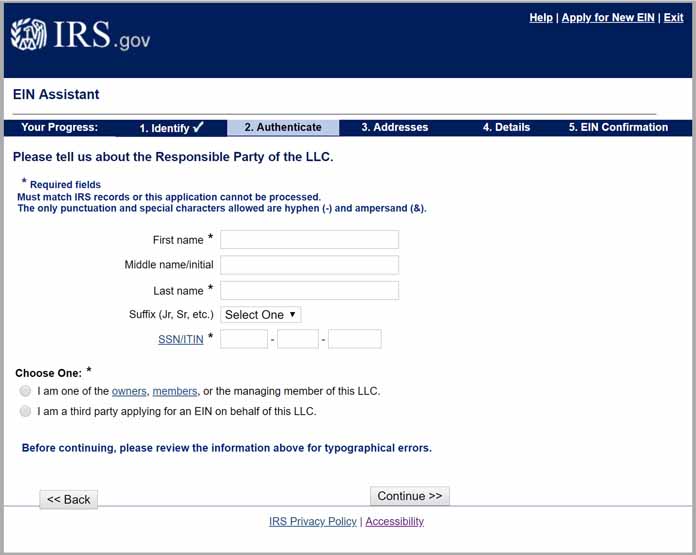

When forming a limited liability company (llc ), you'll need to apply for a federal tax id number, or employer identification number (ein), for tax purposes. How to apply for a federal tax id (fein) number: The irs will provide the ein to the.

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg)

/application-form-w-9--request-for-taxpayer-identification-number-tin-and-certification-close-up-shot-867665546-af6d55c962a24fe38165f2a1aa45f726.jpg)