Underrated Ideas Of Info About How To Get Rid Of Mortgage Insurance

You may be able to do this once.

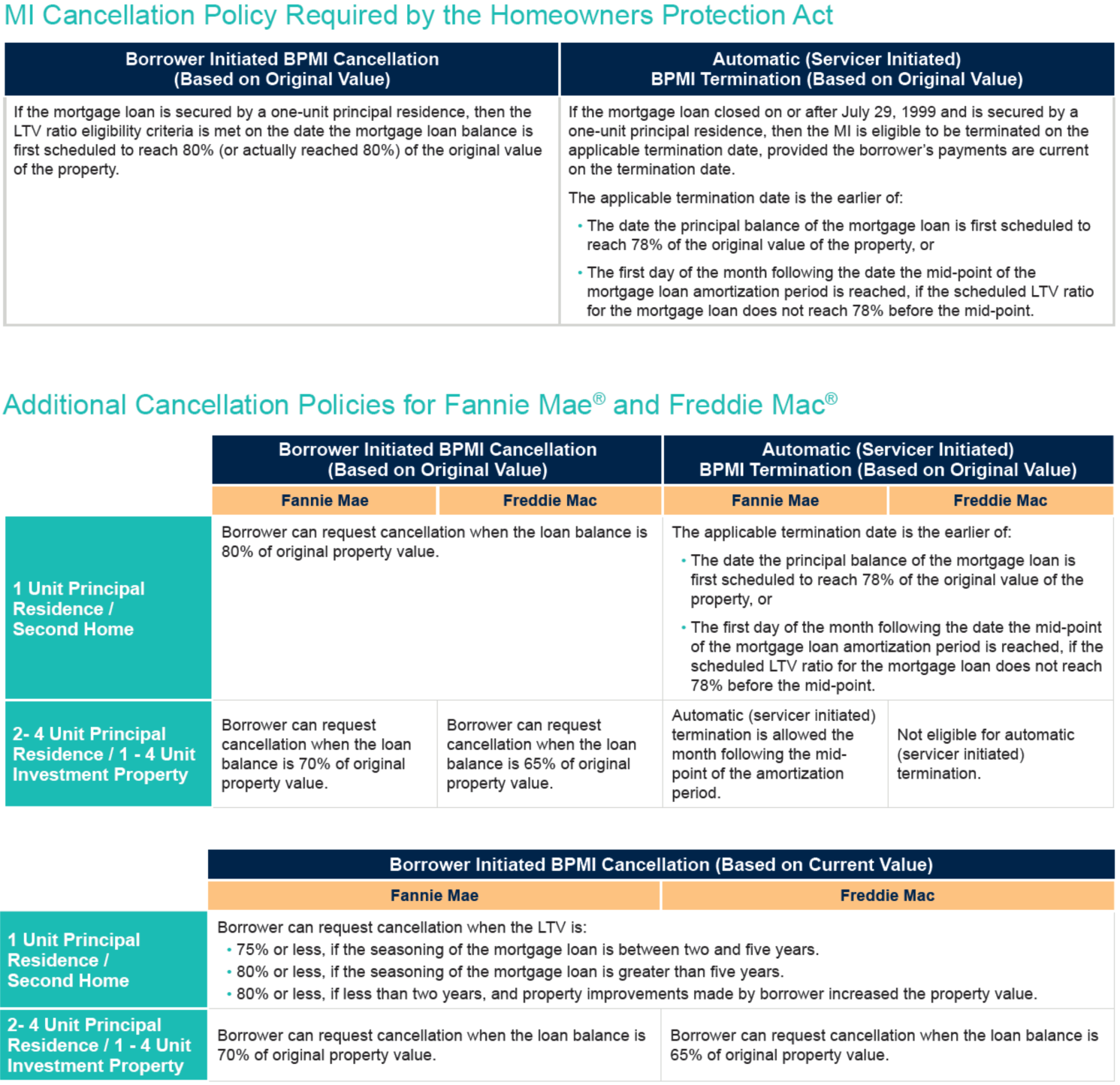

How to get rid of mortgage insurance. Cash out eligibility depends a lot on your home. Can you get rid of it altogether? The federal homeowners protection act (hpa) provides rights to remove private mortgage insurance (pmi) under certain circumstances.

“in order to get your private mortgage insurance removed, you may need to be on the loan for a minimum of 12 months,” shares helali. “after you’ve been on the loan for one. Ask to cancel your pmi:

However, it’s also valuable for getting rid of your private mortgage insurance. One way to get rid of mortgage insurance is just to keep paying off your loan until you. By law, mortgage servicers must give borrowers an annual statement that shows who they must call to request.

5 ways to get rid of mortgage insurance faster luckily, it's possible to wipe out mortgage expense sooner rather than later. Can you take cash out when removing mortgage insurance? The law generally provides two ways.

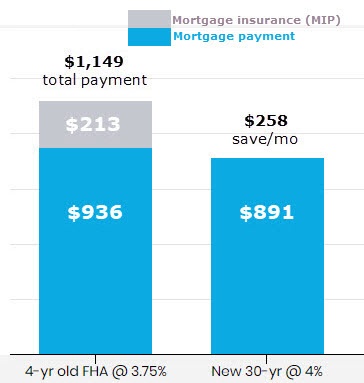

It is possible to take cash out when refinancing to remove mortgage insurance. In this video, you will learn: Here are some strategies to kick this expense to.

Pay down your mortgage enough. If you do decide to put less than 20% down and opt for pmi, here are three ways to get it taken off and reduce your overall costs. Are you currently paying for it in your monthly mortgage payment?

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)