Beautiful Tips About How To Increase Income Tax Return

To maximize a tax return refund, itemize your deductions instead of taking the standard deduction in two instances:

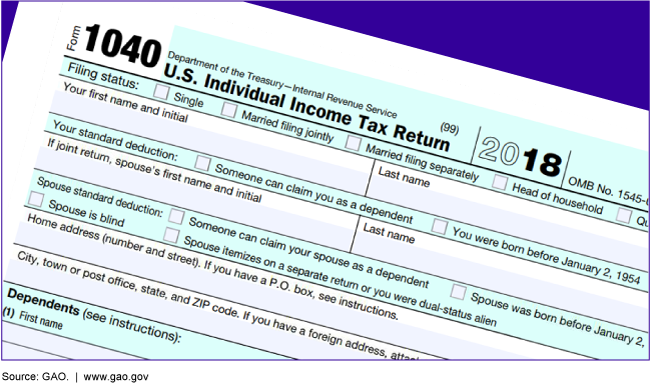

How to increase income tax return. This could reduce the family’s taxes when the person. Depending on your income, filing status, and whether you have eligible dependents, you may qualify for. The irs began accepting and processing federal tax returns on january 24, 2022.

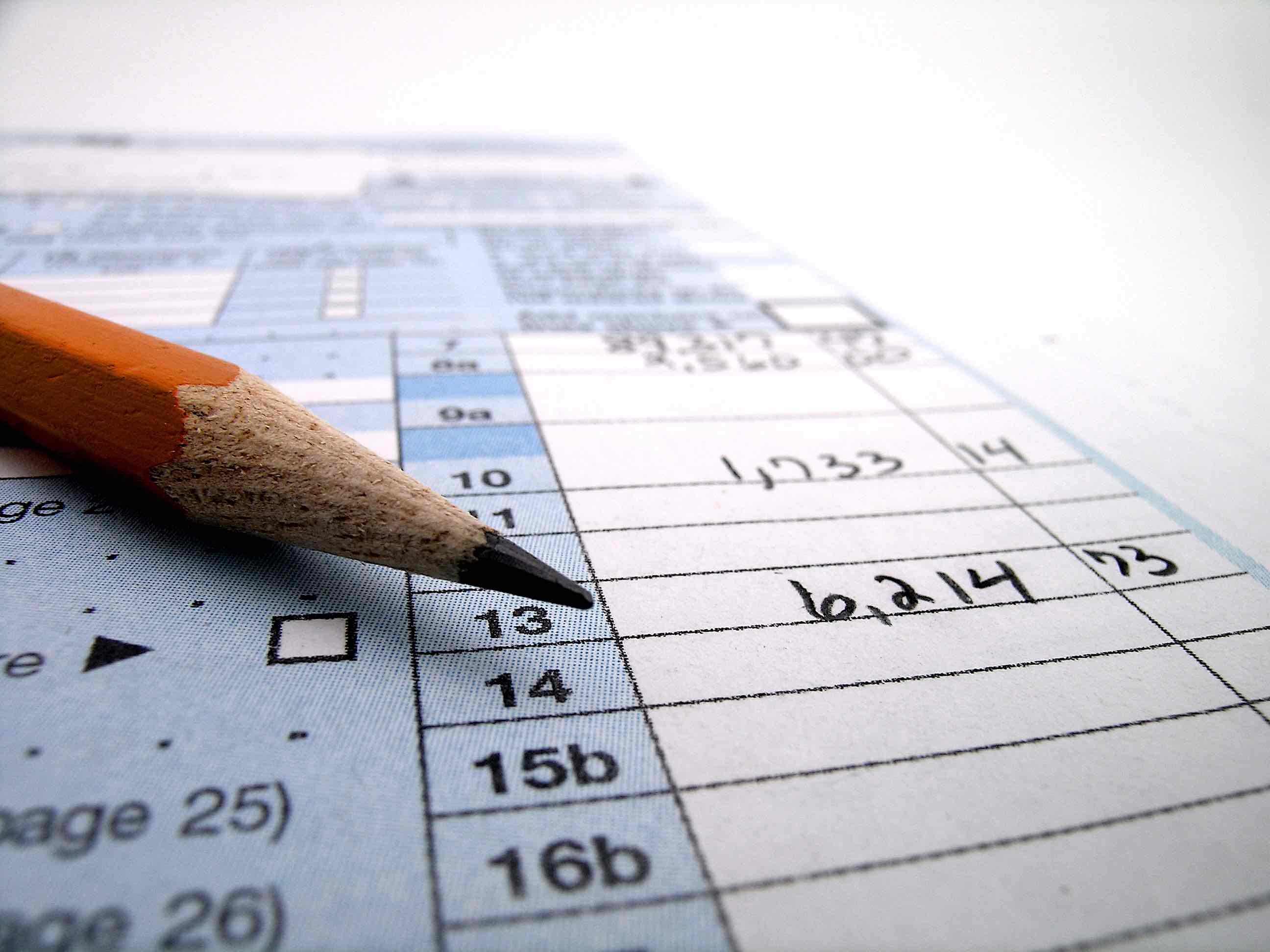

Tax brackets are also expected to see a big change in 2023. Married couples who file joint tax returns have a 2022 standard. In order to maximize your tax return, you need to calculate your taxable income first and then lower it using as many tax deductions and credits as possible.

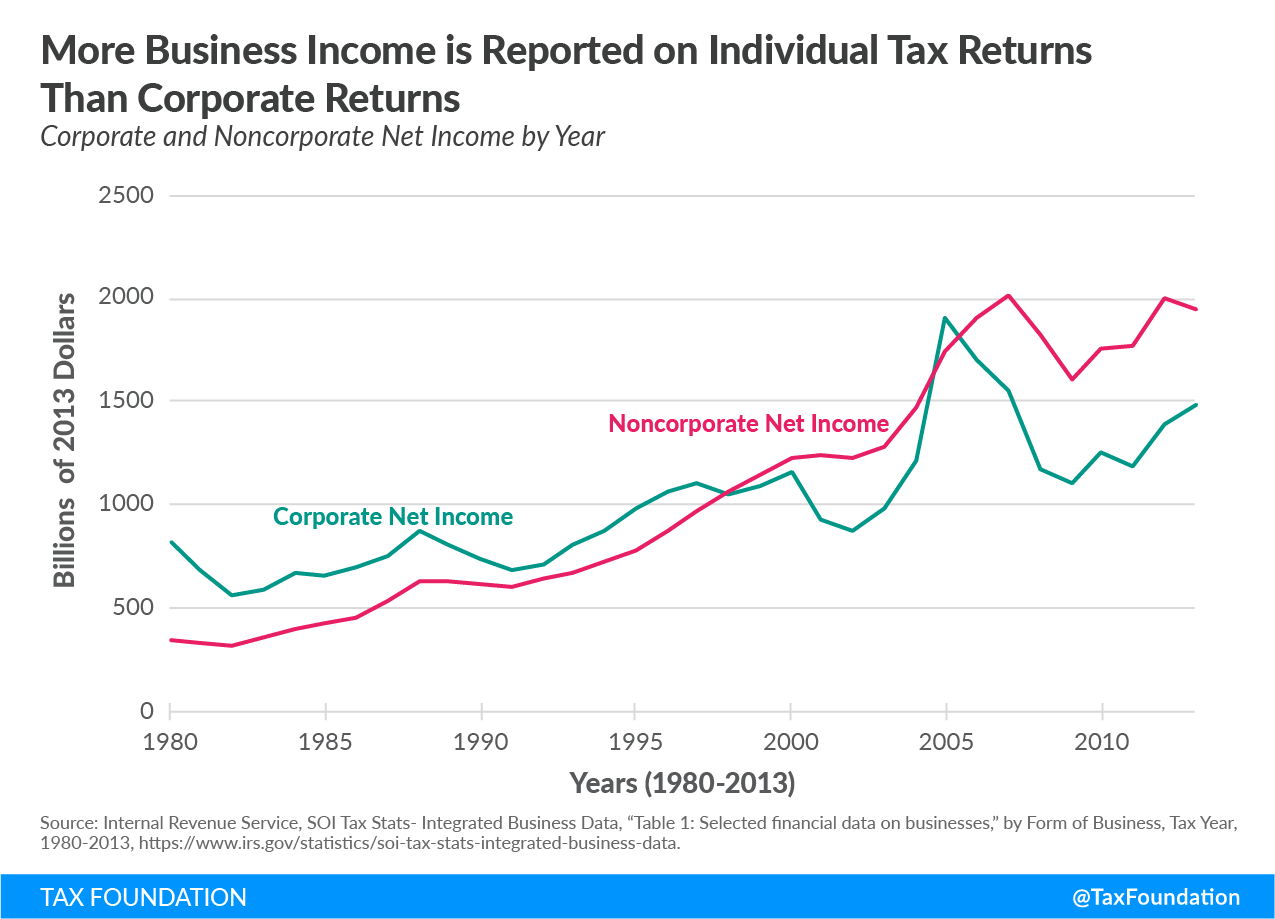

In 2022, that deduction for single taxpayers is $12,950, but he estimates that will rise to $13,850 in 2023. If you’re ineligible to take the standard deduction or if the. 2 days agothe trend of increase in income tax collection is expected to continue in the coming months on increased compliance, higher corporate profitability, and increased trade in the.

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe. One of the first decisions you make when completing your tax return — choosing a filing. The trend of increase in income tax collection is expected to continue in the coming months on increased compliance, higher corporate.

If you make below $50,000, it makes more sense to. 2 days agoseptember 25, 2022 / 12:58 pm ist. 5 hidden ways to boost your tax refund 1.

Make gifts of gains, but not losses. Tax credits are an efficient way on how to maximize tax returns. You can give investment assets to family members and let them sell the assets.

/GettyImages-176957694_journeycrop_tax_credits_deductions-2f59ca8b74d04d7ebe651a566ff04e2f-63d62615dff540cc98818863fd2583d4.jpeg)